MWF Michigan Entrepreneur Resilience Fund

May 13, 2020Resilience Microloan and Grant Fund

With the generous support of MEDC, NEI, Michigan-based foundations, corporate partners, individual donors, and in collaboration with the SBA, the Michigan Entrepreneur Resilience Fund has secured funds to provide recovery grants and loans to diverse entrepreneurs and small businesses from underrepresented groups in Michigan. This fund is intended to assist geographically and demographically disadvantaged individuals.

The Michigan Entrepreneur Resilience Fund will provide two primary avenues of funding:

- Grants: $1,000 – $5,000 grants to assist with reopening or pivoting your business.

- Microloans: $5,000 – $10,000 loans with a 1-3 year repayment period. Loans are fixed rate (8%), fully amortizing, term loans.

Eligibility

Requirements to apply for a Resilience Grant:

- Your business is ready to pivot, reopen and/or accommodate this new business environment.

- You have generated business revenue for at least 12 months with a maximum of $500K in annual revenue and you have fewer than 50 employees.

- You can demonstrate a negative impact on your business operations due to COVID-19.

- You are able to submit a Cash Flow Forecast and Recovery Plan. A template will be provided by Michigan Women Forward within the application.

- Michigan-registered and in good standing (provide Certificate of Goods Standing) with

priority given to:- Businesses located in disadvantaged area within a U.S. Small Business Administration designated HubZone or

- Opportunity Zone. Check the following maps: HubZones and Opportunity Zones.

- (Recommended, Not Required) You are able to provide historical financial statements for your business (i.e. P&L statement).

- You are a low-to-moderate income business owner.

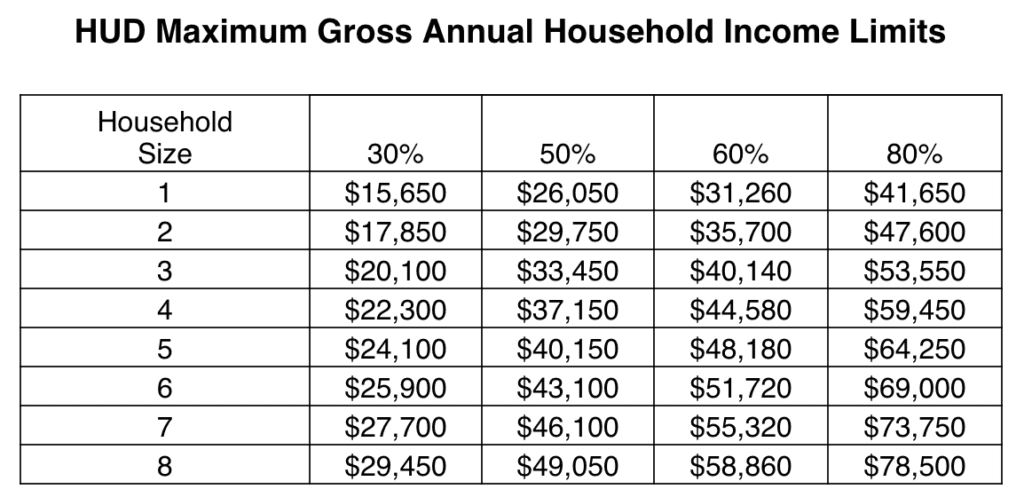

Low to moderate business owner is defined in the chart above as being below 80% of the HUD Maximum Gross Annual Income Limit.

All grant eligibility requirements listed above are required to apply for a microloan PLUS these additional requirements:

- You are unable to access debt financing from a traditional source (i.e. banks, credit unions)

- You are able to provide the following documents:

- Tax returns

- Most recent business tax return (minimum of 1 year)

- 3 years of personal tax returns (most recent filings)

- Historical financial statements for your business (ideally a month by month P&L statement, however, quarterly will suffice)

- Projected business financials (i.e. P&L, Cash Flow) for expected term of loan

- Secondary income confirmation, if applicable (i.e. paychecks, stubs)

- Tax returns

Candidates must meet these criteria and agree to share financials and other essential information as needed.