Polling Shows Why Chamber-Backed PPE Tax Relief Critical for Michigan Recovery

June 9, 2021While COVID-19 cases have fallen precipitously in Michigan in the last few months, and vaccination rates have steadily increased, new polling from the Detroit Regional Chamber and the Glengariff Group released on shows why PPE tax relief is more critical than ever.

PPE Saves Lives and Businesses

The onset of the global pandemic introduced public health tactics like ‘social distancing’, ‘lockdowns’, and ‘quarantining’ that slowed the spread of COVID-19, but caused deep economic hardship. The widespread production and purchase of PPE starting in the latter half of Q2 through the end of 2020 spurred a return to economic growth. Businesses spent millions of dollars making sure their employees and patrons were safe. All those purchases in Michigan were taxed at the 6% sales and use tax rate, which added further burden to businesses during a time of fiscal uncertainty and operational challenges.

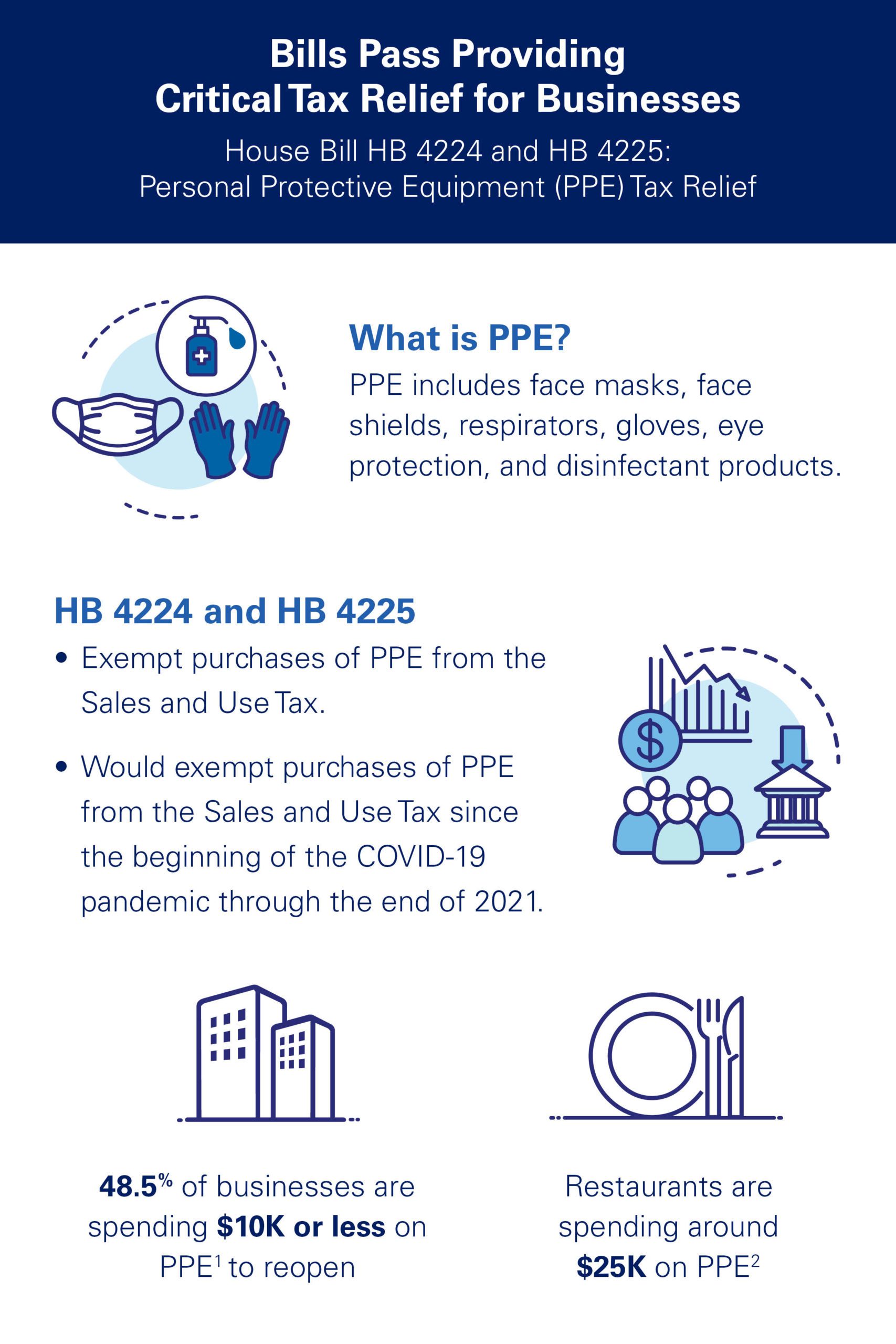

To address the operational and financial burden businesses faced, the Detroit Regional Chamber helped introduce legislation that exempts PPE and other tangible personal property from the taxes if they were specifically used in relation to COVID-19.

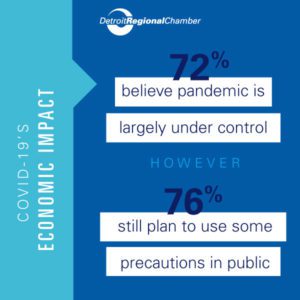

Polling Shows Need for PPE

While our poll shows a plurality of respondents believe the pandemic is beginning to get under control, an overwhelming majority (75%) acknowledge the reality that these mitigation techniques must continue. Responsibly controlling the pandemic and the steady reintroduction of pre-pandemic norms is why the Chamber is pleased that despite a bitterly political environment, Democrats and Republicans came together in the Michigan Senate last week to unanimously approve eliminating Michigan’s Sales Tax on PPE, so government stops profiting from the necessity of it during this pandemic.

The bills’ exemptions would be retroactive and would apply beginning Mar. 10, 2020, until Dec. 31, 2021, and estimates from non-partisan fiscal agencies anticipate the HB 4224 and 4225 will save Michigan businesses $18 million. That is only a fraction of what companies spent to stay open and save lives, but every dollar will go a long way to help ensure that our state experiences an equitable and sustained recovery.