What Small Businesses Need to Know About the Latest Round of COVID-19 Relief Funding

January 6, 2021

The U.S. Chamber of Commerce outlined the latest updates on federal COVID-19 relief funding, especially for small businesses. Content Director Jeanette Mulvey spoke with U.S. Chamber Executive Vice President and Chief Policy Officer Neil Bradley on what funding is available and what small businesses need to know now.

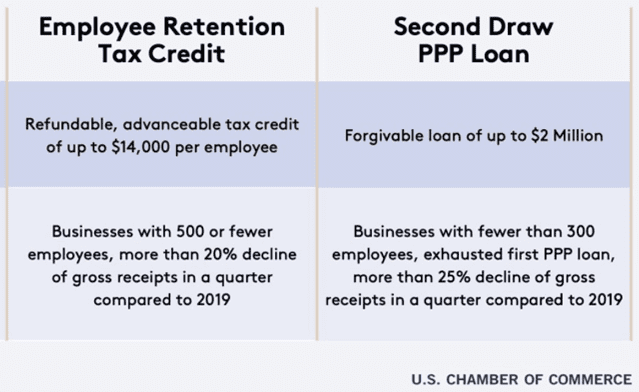

Bradley cited the Employee Retention Tax Credit (ERTC) and Second Draw Paycheck Protection Program (PPP) loans as the two biggest problems available to help small businesses going forward. View an at-a-glance outline of these programs below.

ERTC

ERTC

Among the most significant updates in this round of funding is that businesses can now apply for both the ERTC and PPP loans. In the spring, when businesses could only apply for one of these programs, most opted for the PPP loans. This update poses a generous opportunity for funding that small businesses did not have before.

“This is a tax credit that’s applied against what employers’ remit for withholding,” said Bradley. “It’s a refundable credit, so the IRS sends you a check for the differences between your taxes paid – or what you would have paid – and what you’re eligible for the tax credit. More importantly, you can even apply at the IRS to receive an advance on this tax credit.”

Because this credit is related to payroll taxes, small businesses that use a payroll company should consult that company about the program, which deducts payroll taxes on the businesses’ behalf. Businesses should work with their tax representative or preparer to apply for this credit.

Second Draw PPP Loans

The latest round of PPP loans is another opportunity for the hardest-hit small businesses to get another forgivable loan based on their payroll cost, meaning those who have already received a PPP loan can apply for a second draw.

Its terms are also more targeted with an employee count limit of 300 instead of the previous 500. Businesses must also demonstrate revenue reduction in one quarter of 2020 of 25% or greater relative to the same quarter in 2019. Further, applicants must have exhausted all their original PPP funding to get a second loan.

It is also important to note that the original PPP will reopen to issue new loans to eligible applicants that have not yet received a PPP loan. The cap for these loans has been updated to $2 million. New this time around is that 501(c)(6) organizations are now eligible for PPP loans. This is a long-awaited and positive update, which the Detroit Regional Chamber has supported from the start.

Other updates to the original program include clarification that PPP loan forgiveness is not taxable, so expenses you paid with PPP loan funds remain deductible as normal business expenses. The list of eligible expenses has also been expanded to include purchases for public health services like plexiglass, drive through setups, etc. As states in the original program, 60% of eligible funds must go toward payroll expenses. Consult your banking institution to help compile and process your application.

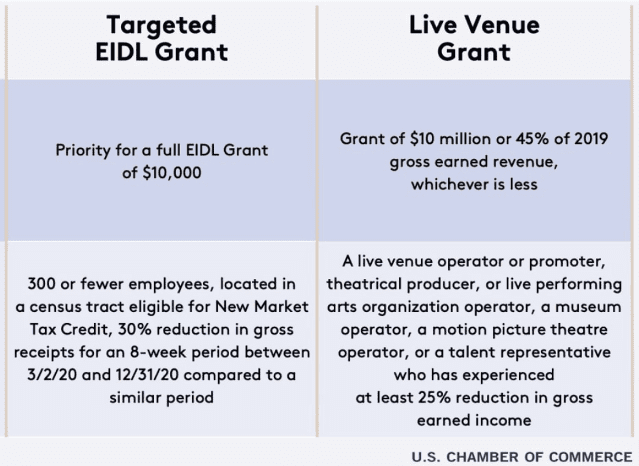

Bradley also explained updates to the Economic Injury Disaster Loan (EIDL) and Live Venue grants. Applications for both grants will soon be available on the Small Business Administration’s (SBA) website.

EIDL

Like the second draw PPP, you can apply for an EIDL grant even if you’ve already received one. This grant is an especially strong option for small businesses in low-income neighborhoods. And because this is a grant, it does not need to be repaid. With this program, there are set-asides for loans made by community development financial institutions, small credit unions, and banks, which better supports minority-owned businesses who faced barriers to financial institutions in prior rounds of funding. There are also set-asides for small businesses with 10 or fewer employees.

Live Venue Grants

The Live Venue grant program is designed to serve live venue operators, promoters, performing arts organization operators, and the like. This is crucial support for a particularly hard-hit sector. The grant program offers more money than PPP and it is a direct grant, so it doesn’t need to be paid back like the loans.

View the full conversation for more information on each of these programs and learn more at uschamber.com.